The Fed looks prepared to continue the fight against inflation even as both U.S. manufacturing and services sectors contracted yet again in December 2022. It is the fourth month of contraction in factory activity and the third month of contraction in services, as both consumers and businesses come to terms with a higher-cost regime.

An interest rate of 4-5% is not unreasonable, but it has been ratcheted up in a very short period of time. People have gotten used to a 0% rate. Will the Fed’s actions topple the economy into a recession, considering the contraction in business volumes already? Or will the soft landing be managed after all?

Experts are divided on this issue. Some are saying that there will be a recession, and some are saying that there won’t be. Some are saying that the first half of the year will be the worst, some are saying the second half will be.

Some expect softness to continue into 2024 and others do not. So uncertainty appears to be at its peak. The only thing that we know for sure is that this year is going to be softer than the last. And we have to work with that.

That and the fact that unemployment levels remain historically low at 3.5%. Therefore, people may be under pressure, but they can still buy.

So what are the things we would normally do when we’re expecting softness? We could hoard cash. That’s certainly an option since we can now earn something on it.

Or we may want to put some money back into the markets, whether through an index fund or through stocks that can handle such uncertainties better than others. Of course, these would have to be in companies selling essentials, because that’s the segment with the most inelastic demand.

Groceries are an obvious choice. And so are supermarkets. Whether we have a recession this year or not, people will still buy food and other essentials. Some will continue shopping online as they started doing during the pandemic. But a lot of others have grown to appreciate the supermarkets again, during the course of the past year.

So as more consumers continue working from home and eating at home, supermarkets are likely to see more traffic and therefore, volumes. Most of the large players also offer online services, so they can provide any of the omnichannel services customers would like. Profitability is something to watch, however, as cash-strapped customers would be looking for bargains, and input costs (including energy) could continue to increase.

Most of the retailers that analysts are rooting for are European companies, which makes sense because Europe’s economy is in a similar situation and it is also more closely affected by the Ukraine war and the energy crisis it spurred. Let’s take a closer look:

Jerónimo Martins, SGPS, S.A. JRONY

Jerónimo operates in the food distribution and specialized retail markets in Portugal, Poland and Colombia. It operates 3,250 Biedronka brand name food stores and 290 Hebe branded health and beauty stores in Poland; 819 Ara branded food stores in Colombia; and 460 Pingo Doce supermarkets, 38 Recheio stores and 4 Recheio platforms in Portugal. It also operates restaurants, stores, petrol stations, coffee shops, and chocolates and confectionary retail stores under various brand names.

The Zacks Rank #1 (Strong Buy) stock, which also has a Value Score of B belongs to the Retail – Supermarkets industry (as do the others discussed here). The industry is in the top 4% of Zacks-classified industries, which means that the constituent stocks have an outsized chance of outperformance.

In the last 30 days, analyst estimates for 2023 have risen an average 10 cents (4.5%).

Analysts currently expect the company to grow its revenue and earnings by a respective 9.7% and 8.7%.

The shares are trading below their median P/E over the past year, although they are at a slight premium to the S&P 500 (as has usually been the case historically).

J Sainsbury plc JSAIY

J Sainsbury is a retailer of food, general merchandise and clothing, and also offers financial services. It operates in the United Kingdom and the Republic of Ireland through three segments: Retail Food, Retail General Merchandise and Clothing, and Financial Services.

The Zacks Rank #1 stock has a Value Score A.

In the last 30 days, analyst estimates for 2023 (ending March) have risen an average 13 cents (14.6%) and for 2024, 7 cents (8.3%). Revenue and earnings are still expected to decline slightly this year.

The shares are trading at a 27.2% discount to the S&P 500.

The Kroger Co. KR

Kroger is a U.S. retailer. It operates combination food and drug stores, multi-department stores, marketplace stores and price impact warehouses.

The Zacks Rank #2 (Buy) stock has a Value Score A.

In the last 60 days, analysts have raised their 2024 (ending January) estimates up a couple of cents. The Zacks Consensus Estimates for revenue and earnings currently represent 2.9% revenue growth and 1.4% earnings growth this year.

The shares are trading at a 38.5% discount to the S&P 500. They are also below their own median level over the past year.

Tesco plc TSCDY

Tesco engages in retailing and retail banking activities. It offers food products through approximately 4,752 stores in the United Kingdom, Republic of Ireland, the Czech Republic, Slovakia and Hungary, as well as online.

The Zacks Rank #2 stock has a Value Score A.

The Zacks Consensus Estimate for 2023 (ending February) has increased 3 cents in the last 7 days. The 2024 estimate has increased 2 cents. At the current levels, earnings are expected to be down about 15% on revenue growth of 17.7% in 2023 and down about 7% on revenue growth of 1.9% in 2024.

The shares are trading close to their median levels over the past year and at a 28% discount to the S&P 500.

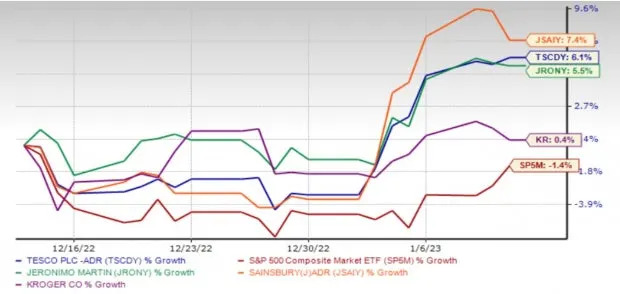

One-Month Price Performance