The United States and the European Union have been discussing the process of overcapacity production with China in many sectors, products and areas due to China’s high production capacity for quite some time.

Discussions and negotiations conducted with China and without Chinese officials, mainly through the World Trade Organization (WTO) and the Organisation for Economic Cooperation and Development (OECD), have primarily focused on iron, steel and shipbuilding.

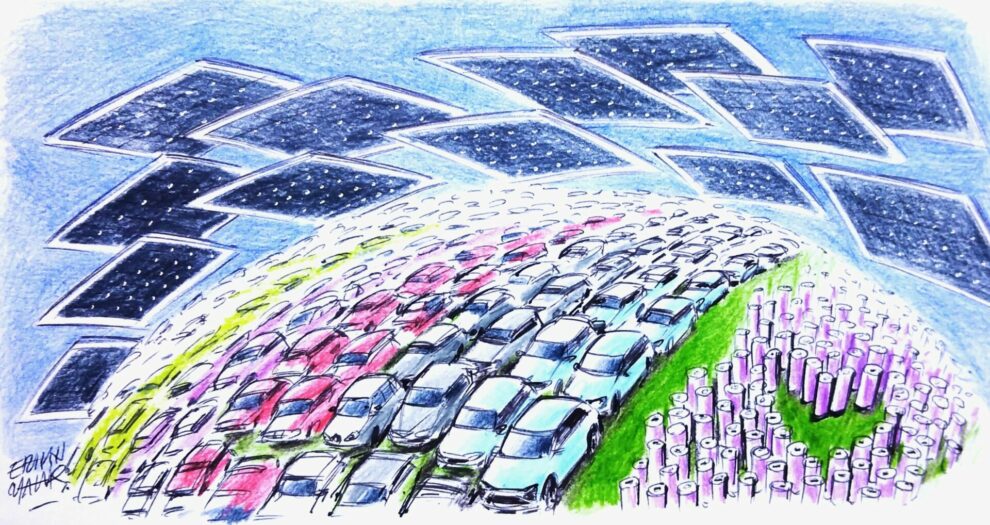

However, when the negotiations turned into a monologue aimed only at meeting the demands of one party, China withdrew from these negotiations. It is now understood that in the past year, three more products have been added to iron and steel and shipbuilding: electric vehicles (EVs), lithium batteries and photovoltaic products.

This issue was also brought up by European Commission head Ursula von der Leyen during Chinese President Xi Jinping’s visit to France, particularly in his meeting with French President Emmanuel Macron while he was touring three European countries. The green transformation, deemed essential by the G-7 economies to combat the global climate crisis, emphasizes the urgent shift from carbon-based energy sources and fossil fuels to clean, renewable alternatives. It is becoming increasingly apparent that a fourth category, critical mines and minerals, needs to be included alongside the existing three. This is because competition is intensifying for products crucial to the green transformation, particularly in the realm of fully electric vehicles, which are vital for achieving a fully electric future.

In the race for dominance in the realm of fully electric vehicles, Europe is finding itself increasingly challenged by China’s remarkable technological advancements and the effective balance between vehicle quality and affordability, causing significant unease in the U.S. China’s annual production of electric cars has surged from 1 million vehicles to 10 million vehicles annually since 2017, with exports surpassing 1 million units, up from just 100,000 over the same period. Consequently, numerous countries have initiated high tariffs on automobiles exported from China, prompting the U.S. to raise tariffs from 25% to 100%.

G-7 faces dilemma

The key question arises: Is China providing subsidies for these products, as some countries and factions allege, or are they entering the market at a low production cost and a price equilibrium that challenges the economies of the G-7 nations?

As a result, G-7 economies face a significant dilemma. On the one hand, in light of the latest reports of the International Energy Agency (IEA) and the discussions and decisions taken at COP26, COP27 and COP28, investments need to be at least doubled for the transition to a 100% electric and clean energy-based world. On the other hand, the global necessity is for widespread access to triple products in large quantities at an acceptable cost and price, to accelerate the green transformation. While the whole world is in search of these products, China’s export increase in these products reached 132% in electric vehicles, 87% in lithium batteries and 68% in photovoltaic products, which are critical for solar energy, in just one year.

Despite China’s denial of allegations regarding excess capacity and subsidies, if G-7 nations are genuinely committed to combating the global climate crisis, as emphasized in international reports, China must naturally leverage its advanced production capacity to meet the surge in global demand for green transformation products. However, it appears that competition with China will intensify, particularly for the U.S., EU, Japan and South Korea, across the fields of triple products, critical minerals and semiconductors and chips.

Source: Daily Sabah